Recently, I was watching a television show called Open Court, which is a basketball show that features retired basketball players who had great professional careers. I just returned from Italy and wanted to catch up on the NBA finals. This show is great because it gives casual fans and basketball enthusiasts an opportunity to gain insights about the mindset and lifestyle of professional athletes. These players on the show shared some interesting perspectives about why professional athletes end up broke even after making millions of dollars.

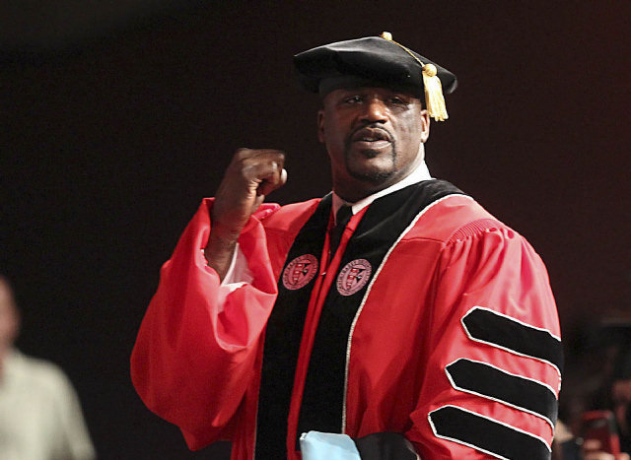

Shaquille O’Neal made an interesting comment that in my estimation should have been discussed more in detail. He said, “…The best word I learned is annuity. The way it was explained to me was, guys make a lot of money and then when you finish playing, you get some of that money back after you finish playing… We need to educate ourselves”. The great lesson in O’Neal’s comments is that the information is within our grasp, but we have to take an active role to acquire knowledge and then apply what we learn.

What Is An Annuity?

An annuity is an investment that you make that provides tax-deferred growth, guarantees, safety, a death-benefit, flexibility, and the option to have a monthly stream of income that you cannot outlive. In other words, an annuity is like having a pension plan that is not tied to your job, but potentially pays you for the rest of your life. If you are a Baby Boomer and you are ready to retire, an annuity is a great option for your hard earned money to grow without market risk if you structure it properly.

How You Can Use An Annuity

If you were born in the post Baby Boomer era, chances are you have little or no intention to stay at your current job for 30-plus years. However, if you have a nest egg that you have been growing through your previous (or soon to be previous) employer, you have the option to place that money in an annuity and continue to grow your nest egg until you are ready to retire. Just make sure that you don’t get too anxious and spend the money early because you will make Uncle Sam very happy. When you have an annuity, the tax code currently requires you to leave the money in the account until after you turn 59 ½ to avoid a 10 percent early withdrawal penalty.

Long-Term Value Of An Annuity

Shaquille O’Neal pointed out that if pro players take 50 percent of their income and put it into an annuity, they would be able to survive financially after their NBA career. To put this in perspective, if an “average” NBA player starts at age 22 and makes $10 million (after taxes) over the course of his career, and places half of it in an annuity for 30 years, this is what it could hypothetically look like:

- $5,000,000 earning 6% for 30 years = $28,717,455.86 –(Accumulation from Age 30 until 60)

- At age 60, if he lives on 5% per year = $119,656.07 per month.

The challenge of O’Neal’s idea is to convince people to value the idea of deferring gratification, which is a virtue that American culture seems to appreciate less these days. Those of us who follow basketball know that O’Neal is a big kid at heart, but I also recognize that he took some wise steps to remain relevant even after his playing days stopped. He still receives millions of dollars from a combination of commercials, product endorsements, and his work as a basketball commentator.

Although Shaq has earned more than most, he also saves more than most. For people who have the vision and discipline to take steps now to ensure a financially stable future, Shaquille O’Neal provides a great example by using an annuity to fulfill that objective.